Opinion:

Regulatory Oversight or Overreach?

You be the judge.

Join the conversation!

Scroll down on mobile to comment on this page or on individual blog pages.

A Republic - If You Can Keep It

I passed a house this morning with a simple black-and-white sign in the window: No Kings. The words landed heavier than usual today. Not because I had not seen them before—I have, many times—but because lately, it feels as though we need to say it louder, and more often.

“Alligator Alcatraz” Violates the Constitution—Nevadans Must Demand It Be Shut Down

The site now referred to as “Alligator Alcatraz” represents precisely such a breach. Credible reports describe maggots in food, flooding, mosquito-infested quarters, denial of hygiene, and a systemic lack of access to counsel. These conditions are not unfortunate bureaucratic failures. They are constitutional violations.

Opinion: How the SEC’s Internal Failures Undermine Investor Trust

The Securities and Exchange Commission recently exposed significant shortcomings in its internal control systems, placing its role as the financial sector’s watchdog under scrutiny. In April 2022, the SEC openly acknowledged a “control deficiency” between its enforcement division and its adjudication division. Specifically, employees gained unauthorized access to confidential legal memos, compromising the integrity of multiple ongoing investigations. Subsequently, in June 2023, a follow-up statement unveiled that the problem was even more extensive than initially indicated.

Opinion: Who Truly Benefits from SEC Whistleblowers?

On May 5, 2023, the Securities and Exchange Commission announced that it had given its largest whistleblower award ever, nearly $279 million, to an unnamed individual whose “information and assistance led to the successful enforcement of SEC and related actions,” according to the SEC’s press release.

In that same press release, Gurbir S. Grewal, director of the SEC’s Division of Enforcement, said, “The size of today’s reward – the highest in our program’s history – not only incentivizes whistleblowers to come forward with accurate information about potential securities law violations, but also reflects the tremendous success of our whistleblower program.”

Opinion: A New Year, But Still the SEC Is Nowhere to Be Found

We have observed how individuals are punished heavily by the SEC with threats of huge fines, the loss of their business, and more. Yet, for some groups, the SEC seems to look the other way. For example, when more than 70 members of Congress were identified as being in violation of the STOCK Act of 2012, they received only a fine of $200, which may be waived by House or Senate ethics officials. In recent months, it seems that this trend has not changed.

Opinion: Judges Speak Out About SEC Gag Orders

“What is the SEC so afraid of? Any criticism, apparently — or rather anything that may even ‘create the impression’ of criticism of that governmental agency.” This is a direct quote taken from a recent ruling by U.S. District Judge Ronnie Abrams in response to the SEC’s decades-old “No-Admit-No-Deny” provision. It may seem rare to hear such a scathing review from a public official, but Judge Abrams is not alone in her opinions.

Opinion: A Fundamental Right Denied

We often think of our right to appointed counsel as an inalienable right. After all, it was included in the Sixth Amendment to the U.S. Constitution and ratified as part of the Bill of Rights in 1791. However, the work done to have this right applied fairly and equitably has been arduous, and here's why I believe there is still much more work to do.

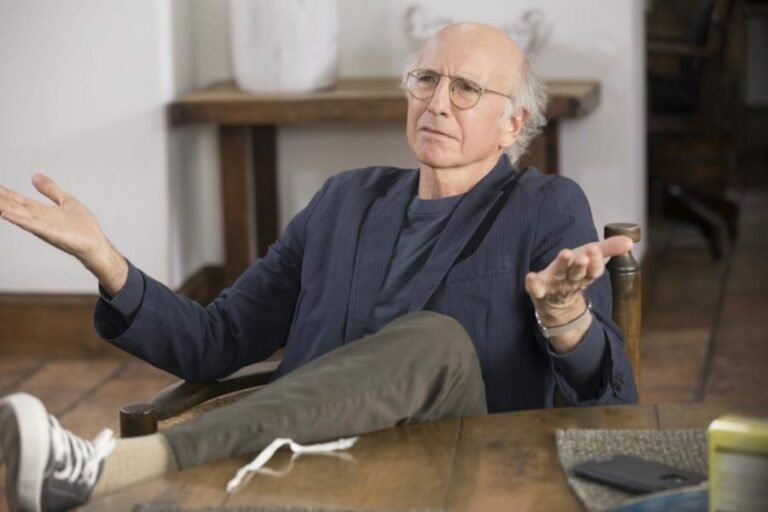

Opinion: Are Celebrities to Blame for the Fall of FTX?

While many people watched Super Bowl LVI for the football, many others watched it for the commercials. One commercial that particularly stood out was that of Larry David rejecting a number of inventions throughout history, such as the wheel, the lightbulb and, more recently, cryptocurrency. Specifically crypto as sold through the exchange, FTX. At the time, the commercial was meant as comedy. “Don’t be like Larry!” it declared. “Don’t miss out on crypto!” With recent events and FTX’s fall from grace, though, the commercial seems more prophetic.

Opinion: SEC Uses Kardashian as an Example of Enforcement

When it comes to marketing, one time-honored tradition is the celebrity endorsement. Turn on your TV or open up your web browser and you’re likely to see any number of athletes, actors and influencers trying to sell you anything from cars to credit cards. Arguably the biggest celebrity influencer today is Kim Kardashian. So, we should not have been surprised to see Kardashian shilling a new crypto token – and we should not be surprised to see the SEC stepping in to fine her.

Opinion: Where Is the SEC?

In our previous article, we discussed how the Supreme Court egregiously missed a chance to do right by the American people when it refused to hear former Xerox executive Barry Romeril’s case and take a closer look at the SEC’s gag order policy. Today, we will look at how Congress has also let its citizens down and how the SEC has seemingly turned a blind eye.

Opinion: The Supreme Court Misses its Chance to Do Right

Freedom of speech is our first and, arguably, most vital right as Americans. When a powerful government agency demands that we do not speak ill of it, this is a dangerous road towards tyranny. Our financial industry is built upon so much disclosure and transparency, and there is no reason why the SEC should be the exception to that rule. The Supreme Court has let down the American people and missed a chance to right the wrongs of the SEC by refusing to hear former Xerox exec Barry Romeril’s case.

Opinion: SEC & Regulatory Overreach – Nondelegation Doctrine

The SEC accused Schwab of not disclosing hidden fees and allocating funds in a sub-optimal fashion. Charles Schwab, a company with an excess of $8 trillion in assets under management, decided to accept a nearly $200 million fine because they felt that was the better business decision. If a global giant like Schwab believes that it makes more financial sense to settle with the SEC, what hope do smaller firms have?